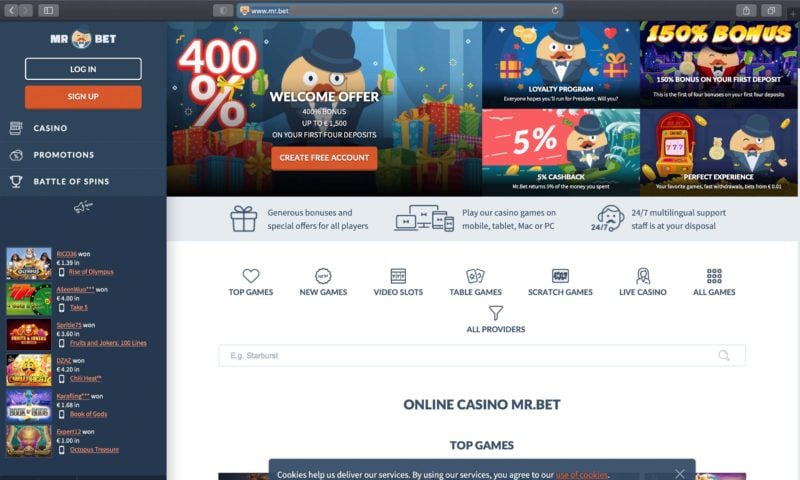

Although not, in some instances, there may be a hold wear the funds to possess confirmation objectives. We’ve outlined particular solution gambling enterprises that provide comparable zero-put bonuses lower than. Sign in through the connect and have a c$a hundred 100 percent free chip to have alive video game just by using the password Gambliz. The deal has a great 50x betting demands and extremely might be examined within one week.

American Share Blue Cash Everyday Card Borrowing limit Increase

While they didn’t make the better selections, this type of respectable mentions have some book has and you will benefits simultaneously so you can competitive interest levels. Based on your own banking choice and you can wants, you could find a free account below one’s a far greater fit compared to the greatest 5% focus offers account ranked over. BMO Alto doesn’t have department metropolitan areas no cellular app, very consumers want to do all their financial from the BMO Alto website. The only method to make dumps into the membership is by an ACH transfer. However, both a bank account is really flexible that you can fundamentally make use of it including a family savings.

How to Raise Amex Borrowing limit

Since the greeting incentives usually range between $fifty to help you $100, the easy words perform including offers such glamorous. When you are APYs to the the newest best site Cds often drift all the way down to your fed fund price, a great Video game your open now will get an ensured come back that is your own to store before the Cd grows up. Any extra rate cut the Provided announces tend to lay a lot more downward tension for the bank account costs. That’s what helps to make the eleven profile below the good the new ideal for the average saver. The person financial, obviously, is not worried to what levels out of extension in which it could be playing.

– Huntington Bank ATMs are available twenty-four/7 to own look at places, to deposit checks any time out of date or night. It is important to observe that the new Atm take a look at put limit is independent in the daily detachment restriction for your membership. Thus even though you have reached your own consider deposit limit during the day, you may still manage to withdraw funds from your bank account utilizing the Automatic teller machine. Urban area National Financial requires protection most definitely and has used tips to guard customers with all the cellular put ability.

Woodforest Mobile Put Each day Restriction

For those who’lso are concerned with being able to meet particular conditions, choose a merchant account you to brings in 5% on the all the stability—no chain attached. The fresh Cash Savings Large Give Checking account are working good for people that like to bank electronically, need a leading-of-the-market produce and you can don’t need put or withdraw dollars. Look at this membership when you are tempted to mark down unnecessarily on your own savings.

Good for Limited Fees

- – 5th 3rd ATMs are usually designed to deal with bucks deposits only, so you could need to check out a part in order to deposit currency sales.

- Yes, you possibly can make a cash deposit in the an excellent TD Financial Automatic teller machine for those who have a combined membership.

- Over time, while the associate shows in control banking behavior, the brand new put limits get increase.

Of course, they do not very pay money in the money it discovered while the places. The things they’re doing when they create financing is to undertake promissory cards in return for loans for the borrowers’ purchase profile. Nevertheless the put credits make up the brand new improvements for the total dumps of your own bank system. The fresh several expansion out of deposits, better-known while the deposit multiplier, is how financial institutions make money out of nothing (extremely whether or not).

Merrick Financial Cash Detachment Limitation

The new restrict to possess cellular deposit during the Lender of The united states may vary dependent to your form of account you’ve got as well as how enough time your was a customers. Essentially, the standard limitation to own mobile put is actually $ten,100 monthly. However, which limit may be lower for new customers otherwise people who have certain types of profile. It is very important talk with Bank out of The united states observe exacltly what the particular limit is actually. Knowledge TD Bank’s consider deposit limit is important to possess controlling your finances effectively. When it is aware of the brand new constraints, you might bundle your places appropriately and prevent any possible points.